Is there an advantage to purchasing insurance?

When you need care, the insurance company will pay all or part of the cost. You will have choice and control over where you receive care and the quality of that care.

The disadvantage is that you pay for the coverage. The cost of long-term care insurance depends upon your age and health at the time you apply for insurance, the level of benefits, and the length of time those benefits will last.

Navigating your best options

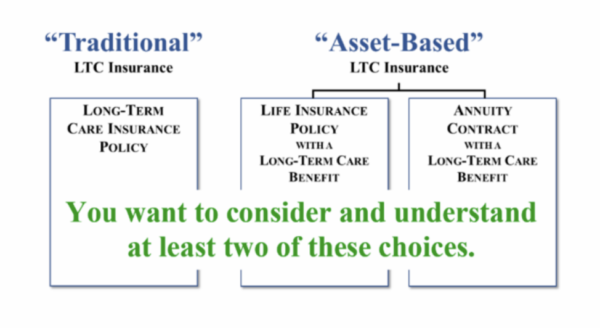

Traditional long-term care policies

Traditional plans are like most other insurance policies you may have. You pay for it monthly or on an annual basis.

You hope you never have to use it, but if you do, there are benefits to help cover your loss. If you don’t ever use it, you don’t collect any benefits.

Traditional long term care plans, unlike asset based plans, allow you to make systematic payments versus taking a lump sum of your assets and losing some control over them.

Be aware that historically, they have experienced some rate increases and you need to prepare for these.

Asset based long-term care policies

Asset based long-term care policies usually start by depositing a lump sum for your premium.

Within asset based, there are typically two types of policies. One is based around long-term care benefit in a life insurance policy. Another is based around long-term care benefit in an annuity contract. The life insurance policy option allows a death benefit to be paid if you never utilize any of the long term care benefits. The annuity contract

Generally, the life insurance option health requirements can be more strict, and ask more health questions than the annuity option. The life insurance option can provide more benefits for long term care or your family will see more benefits in the tax free life insurance payment if the long term care claim is not filed.

The annuity contract underwriting is more lenient, meaning they have less health questions. Generally, you’ll receive what you deposited in the account, plus the interest it earns if death happens with no long term care claims. In some cases, the annuity contract can offer two or three times more your deposit in the form of a long term care benefit.

Once you fund an asset based policy, it’s not generally subject to any future rate increases, meaning there are no surprises for additional premium in the future.

Life insurance with LTC benefits

Many consumers choose these benefits when they want supplemental long term care benefits or the primary goal is death benefit or cash accumulation and the LTC is secondary. Furthermore, some policies offer a true Long Term Care rider and some offer a Chronic Illness Rider.

Both can function in similar ways, depending on what your main goals are. The key to these riders is affordability and accessing your death benefit while you are living should you need it for a long term care situation.

Some long term care policies can provide:

- Tax-free long-term care benefits.

- Inflation protection to benefits.

- Benefits for several years or lifetime.

- A benefit to heirs if you never need care.

Make sure to examine how these benefits apply to the options you’re considering.

But what happens when...

- Insurance is not an option (you are uninsurable because of health reasons or otherwise)?

- Don’t qualify for assistance, but don’t have enough to pay your premiums?

- You choose not to buy insurance for long term care?

So what's the best solution for you?

All of the three types of long-term care protection can be a good choice. The best solution for you depends upon your health, your finances, and your preferences. Finding your best solution begins with a conversation that helps us understand your unique situation; based upon this conversation, we begin the process of narrowing down the many options to find the best fit for you.

Some considerations:

- Look back periods that vary by state and by the resource program.

- Tax consequences if not planned properly or addressed on transferring assets.

- Depending on the document and how it’s prepared, you may or may not use some or all control of the assets.

- Depending on the state and who you’re working with these options/considerations may vary drastically.

Definitions:

- Long-Term Care Partnership Program: A system that allows your estate to retain a higher level of assets and still go on Medicaid if your long-term care insurance policy runs out. Most states have a partnership program that allows you to purchase a partnership-approved long-term care insurance policy.